You may be wondering how to go about retirement planning as an American living in Spain.

The process of preparing for retirement can be challenging for anybody, but it can be more challenging for expats who have to negotiate the complexities of two countries’ financial systems.

In this article, we’ll discuss some of the most important strategies and considerations that should be taken into account by American expats living in Spain planning for retirement.

In this article, we’ll cover:

- Why you should start saving as soon as possible

- Aim to have multiple retirement income pillars

- Where to invest as an expat in Spain planning for retirement

Why you should start saving as soon as possible

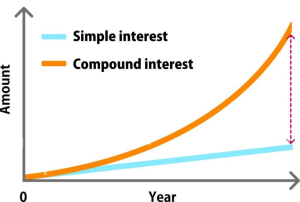

Compounding is one of the most potent ideas in financial investment. It refers to when interest earned on an investment aggregates over time, which results in exponential growth. This is because you earn interest on the accumulated interest as well as on your capital.

The sooner you start saving, the more time your money will have to accumulate interest, which will result in a larger nest egg when you reach retirement age. Since compounding is so powerful, even a small amount saved each month has the potential to develop into a substantial sum over the course of time.

For example, in the first year, if you save $1,000 in a investment that increases by 10% annually, you will earn $100 in the first year, and your balance at the end of the year will be $1,100. If you keep the funds in the same investment for another year and again earn a 10% return, you will earn $110, raising your account balance to $1,210. In the third year, you’ll earn $121, and so on.

This graph illustrates how compounding can accelerate capital growth over time:

The best way to take advantage of the power of compound interest when retirement planning is to invest regularly and for as many years as possible, so it’s always sensible to start saving as soon as possible, whatever your age.

Investing in a retirement savings account can be a great way to take advantage of compounding over the long term. Among the investment options available to you as an American living in Spain are Traditional and Roth Individual Retirement Accounts (IRAs) in the US. Both traditional IRA and the Roth IRAs have US tax advantages, although note that Spain doesn’t recognize these advantages. Consult your expat financial advisor to find the best investment solutions for you.

Similarly, if you contribute to a Spanish private pension plan, note that any tax advantages may not be recognized by US tax authorities.

Aim to have multiple retirement income pillars

Having multiple different sources or pillars of retirement income is more secure and also increases the total income you’ll receive. Ideally, retirees should have access to at least three different pillars of retirement income, such as:

- Social Security / state pension. If you’ve contributed enough, U.S. citizens can collect their social security payments no matter where they are in the world, as well as Spanish social security if you’ve contributed sufficiently in Spain too. If you’ve contributed to both systems but not enough to either country to qualify in either, a treaty called a Totalization Agreement lets you pool your contributions between the two countries and receive social security payments in whichever of the two countries you retire in. The agreement also lets Americans working in Spain not pay both Spanish and US social security contributions at the same time.s

- Company pension plans. Employer sponsored pension plans are common in Spain. If you’re working for a Spanish firm that has a plan, make sure you understand the plan features, such as contribution amount, vesting timeline, and payout alternatives, since these plans can provide a substantial amount of retirement income.

- Individual pension plans and other assets. Retirement income from private assets or individual pension plans should be the third pillar of retirement income for American expats living in Spain. This might involve dividends from stocks, bonds, mutual funds, or other sorts of financial products. Rent from investment property can be another reliable source of income in retirement. The best way to reduce exposure to loss and maximize gains is to invest in a range of different asset classes.

Where to invest as an expat in Spain planning for retirement

Based on historical performance, investing is an effective strategy for long-term financial capital growth. Stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate are just a few of the many financial options available for American expats in Spain. Yet, as an American citizen living abroad, you should be mindful of the tax consequences of any investments you might make.

- As an American citizen living and working overseas, you must still file US tax returns. The United States allows you to claim either the Foreign Tax Credit or the Foreign Earned Income Exclusion when you file to avoid double taxation with Spain. Foreign Account Tax Compliance Act (FBAR) and Foreign Bank Account Report (FBAR) forms may be required to disclose foreign bank accounts to the US government. Furthermore, the PFIC (Passive Foreign Investment Company) reporting may be triggered by investments in certain foreign mutual funds or ETFs, leading to more complicated tax reporting and potentially a US tax liability. You should get expert help before making any investments in Spain.

- You should consider putting money into a regular or Roth IRA in the United States if you plan to spend your retirement there. These programs help you save money in the long run and provide a steady stream of money in retirement. Note, however, that Spain does not recognize US IRA tax breaks.

- Discuss your situation with an expat financial planner who specializes in helping Americans living abroad in Spain invest and plan for retirement. An expat financial planner in Spain can assist you in understanding the tax consequences of investing and creating a retirement plan tailored to your specific situation and objectives.

In conclusion, American expats in Spain should plan carefully, and start saving as soon as possible to take maximum advantage of compound interest. You should aim to build at least three retirement income streams including social security, employer-sponsored pensions, private pensions, or perhaps rental property. US tax and reporting such as FBAR, FATCA, and PFICs must also be considered when retirement planning as an American in Spain.

This article is for informational purposes only; it is not intended to offer advice or guidance on legal, tax, or investment matters. Such advice can be given only with full understanding of a person’s specific situation.

If you have any questions about financial planning as an American living in Spain, get in touch.

This article is for informational purposes only; it is not intended to offer advice or guidance on legal, tax, or investment matters. Such advice can be given only with full understanding of a person’s specific situation.